Some Known Factual Statements About Paul B Insurance Medicare Advantage Agent Huntington

Wiki Article

The smart Trick of Paul B Insurance Medicare Agency Huntington That Nobody is Talking About

Table of ContentsAll about Paul B Insurance Medicare Part D HuntingtonThe Ultimate Guide To Paul B Insurance Medicare Agency HuntingtonSome Ideas on Paul B Insurance Insurance Agent For Medicare Huntington You Should KnowRumored Buzz on Paul B Insurance Medicare Advantage Plans HuntingtonThe 10-Minute Rule for Paul B Insurance Local Medicare Agent HuntingtonAll About Paul B Insurance Medicare Insurance Program HuntingtonExcitement About Paul B Insurance Medicare Agent Huntington

Coverage will begin the month after a person enlists during their SEP.

The individual can sign up at any time while covered under the team health strategy based on present employment, or throughout the 8-month duration that begins the month the employment finishes or the group health plan protection ends, whichever comes - paul b insurance medicare agency huntington. The SEP is a 6-month duration that starts the earlier of the first day of the month complying with the month for which the: person was no longer offering as a volunteer outside of the United States; organization no longer has tax-exempt status; or specific no longer has health and wellness insurance that supplies insurance coverage outside of the United States.

Eligible individuals are those that are: Under age 65, and Eligible for TRICARE Criterion at the time of Part A privilege and: An army retired person or army senior citizen family member, or On active obligation or a relative of an active service service member with Medicare based upon ESRD. If alerted of Medicare entitlement throughout the IEP -The month after the end of the IEP, or If alerted of Medicare privilege after the IEP -The month of alert of Medicare privilege.

Some Known Facts About Paul B Insurance Medicare Agency Huntington.

The month of Part An entitlement, or The month of registration, or The month after completion of the IEP. People who do not sign up partly B or premium Component A when initially qualified as a result of having an emergency or catastrophe proclaimed by a federal, state, or neighborhood federal government entity in their location might enlist utilizing this SEP.The SEP ends six months after the later of: The end day identified in the disaster or emergency situation declaration, or The end date of any extensions or the day when the declaration has been determined to have finished or has actually been withdrawed, or The day of the declaration, if such day desires completion of the catastrophe.

Individuals who do not enlist in Part B or costs Component A when initially eligible due to misstatement or dependence on incorrect information offered by their employer or group health and wellness strategy (GHP), agents or brokers of health and wellness strategies, or any individual authorized to act on part of such entity might sign up utilizing this SEP.

If an individual is eligible due to the fact that they are not signed up in Medicare because of being put behind bars, they can sign up anytime within the first one year after their release from imprisonment. This SEP begins the day a person is released from the wardship of chastening authorities and also ends the last day of the 12th month afterwards release.

The smart Trick of Paul B Insurance Medicare Agent Huntington That Nobody is Discussing

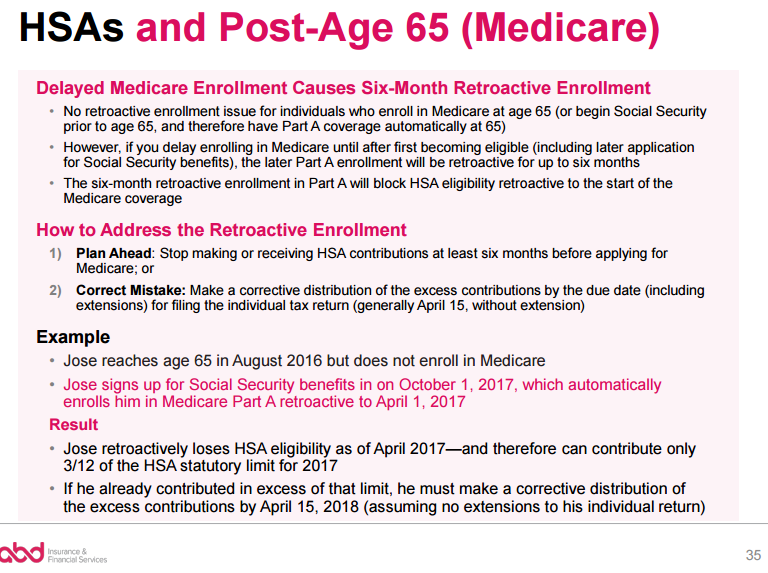

If individuals pick this retroactive choice, they will their explanation be in charge of paying Medicare costs back to the date of protection. Medicare benefits will work the initial day of the month following enrollment, or up to 6 months retroactive, if the recipient, picks retroactive protection. A person might be qualified if they have lost Medicaid completely, missed a Medicare enrollment duration and also their Medicaid insurance coverage was ended on or after January 1, 2023.Medicare advantages start the month after Medicare enrollment unless the private chooses a begin day back to the first day of the month the specific lost Medicaid and also concurs to pay all prior premiums. Individuals who still are eligible for Medicaid, including a Medicare Cost savings Program, as well as have actually not obtained notification of an approaching Medicaid termination are not eligible for this SEP.

The smart Trick of Paul B Insurance Local Medicare Agent Huntington That Nobody is Talking About

People that do not have Component An and also wish to enlist need to complete the CMS-18-F-5 kind or get in touch with Social Security at 1-800-772-1213. This form can be used to enlist in Part B at the exact same time.

Some Ideas on Paul B Insurance Medicare Insurance Program Huntington You Need To Know

Individuals that are looking for the SEP for the Operating Aged as well as see this site Working Disabled needs to complete the type CMS-L564 together with the relevant Component A see or Component B registration form. Individuals entitled to premium-free Part A can not voluntarily terminate their Component A protection. This is not permitted by regulation. Usually, premium-free Part A ends because of: Loss of privilege to Social Protection or Railroad Retirement Board benefits; or Death.Report this wiki page